Client Story

Beauty retailer gains key insights to optimize online checkout journey

CLIENT STORY OVERVIEW

A leading beauty retailer turned to BlastX to gain a deeper understanding of a specific customer purchase experience in its online store and receive recommendations for how it could be optimized.

The retailer has a tremendous following in its rewards program with more than 30 million members. Transactions from these members represented more than 90% of total annual net sales, with the majority happening in its physical stores.

These rewards members shop more frequently and spend more money per visit compared to non-members. When the retailer had to close its physical retail locations due to the COVID-19 pandemic, the Loyalty team was eager to pursue opportunities that could increase membership for online shoppers.

The Loyalty team approached the E-commerce leadership to explore ways to increase the visibility of its rewards program within the shopping flow.

The retailer’s Vice President of E-commerce was interested in exploring this more, but first wanted to be confident that it wouldn’t interfere with shoppers completing their orders.

CHALLENGE

Initially, the Vice President of E-commerce was hesitant about adding a dedicated link to join the rewards program in the checkout because she was concerned it could negatively impact conversion rates. However, she knew the rewards program delivered tremendous value within its retail stores, and it could be a potential driver for increased online sales during the pandemic.

The online store already had an application for a credit card and rewards membership in the checkout. Online shoppers could get an order discount by applying for the retailer’s credit card and joining its rewards program at the same time. While this offer was relevant to the shopping process and increased rewards memberships, her team didn’t know the full impact this was having on its online sales. Before adding any new links to the rewards program, she wanted to gain a better understanding of this new credit card application experience.

To get a clearer understanding, the Vice President reached out to the Blast, and we deployed our Insights team. For many years, BlastX had worked closely on its digital analytics solutions and had a strong knowledge of its business and e-commerce data. With help from BlastX, the Vice President was confident she could quickly get the insights and recommendations she needed to make an informed decision.

SOLUTION

Our Insights team first isolated the volumes of visitors that engaged in this credit card experience and all their subsequent steps, including placing an order. By segmenting these visitors, BlastX was able to compare their performance versus other shoppers who didn’t engage with the credit card experience. The analysis created a series of insights that helped define different unique characteristics and behaviors of these shoppers. Ultimately, Blast was able to identify three key insights about this credit card segment and the value they delivered to the business.

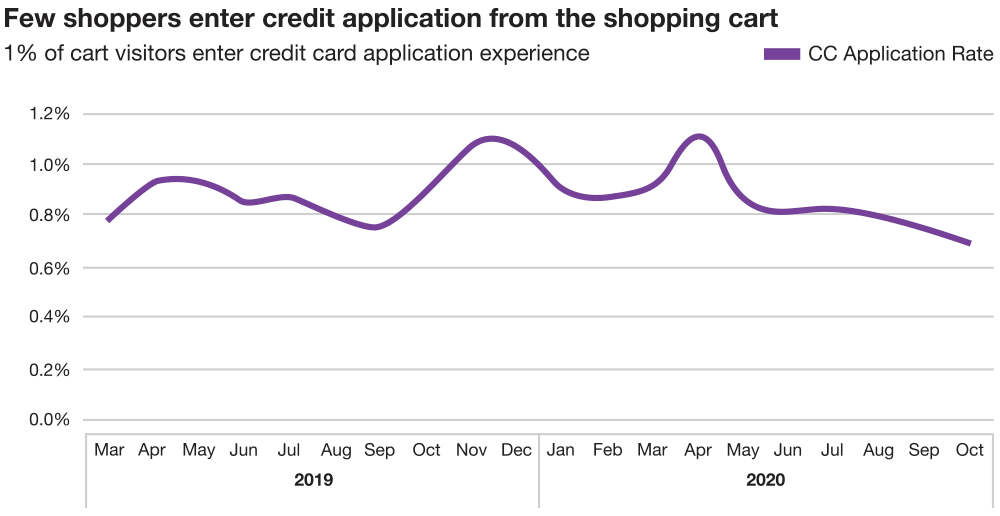

1. 1% of cart visitors entered the new credit card application experience. Of those that did, 9% of them completed a credit application.

Traffic into the credit application page from the shopping cart has consistently been around 1% of cart visitors for the past two years. Of this portion, they discovered around 17% of them exited the site altogether and 9% completed a credit card application. Of those that completed a credit application, over 70% went on to make an online purchase. These shoppers were highly motivated to place an order after getting approved for the credit card and applying the rewards discount to their order. It was also notable that the traffic volume peaked in April during the COVID-19 lockdown like the previous holiday season.

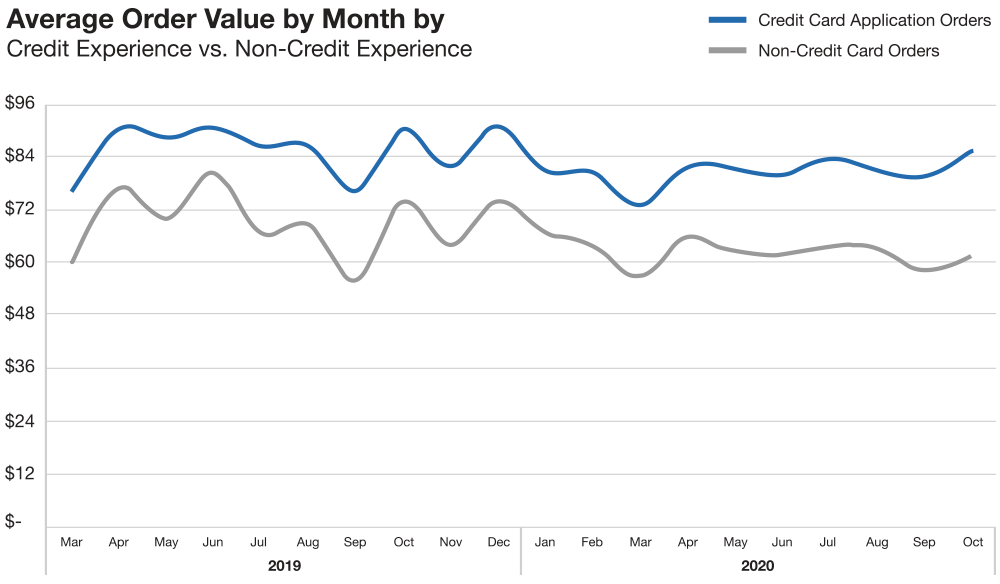

2. Average Order Value of credit card customers were 27% higher.

The shoppers that completed a credit application and placed an order tended to have a much higher average order value than those that did not. This higher order value has remained consistent over the past two years. With higher average order values and much higher repeat purchases, this segment of customers offered a much higher lifetime value than its other customers.

3. New credit card customers (1% of cart traffic) represent 2% of total online sales.

Over the past two years, the new credit card segment’s revenue contribution remained steady, even given the large shift to online shopping in 2020 caused by the global pandemic. Although this segment is only a small fraction of cart shoppers, they delivered a perceptibly higher volume of sales. This suggested there was significant potential to increase total sales by simply increasing traffic to the credit and rewards application experience.

Experience Recommendations

Based on the performance of the new credit card and rewards membership experience, BlastX recommended the retailer to explore and test the following:

- Begin to explore test opportunities for shoppers to join the rewards program independent of the new credit card experience. The lower requirements to join the rewards program could potentially still drive valuable customers at a higher rate than the new credit card and rewards membership does.

- A/B test the verbiage on the call to action into the new credit card experience in the cart. By creating alternative text options, the retailer could discover what messaging may drive more visitors to naturally apply. With a small test, it could deliver a meaningful impact in a short period of time.

- Test adding the credit card application link to product detail pages for products over $100. By emphasizing the purchase price after the new credit card discount, the retailer could achieve higher funnel engagement with the credit card experience and deliver more sales down funnel.

- Test adding a pop-up interstitial for shoppers after they click “checkout” to increase visibility and engagement with the credit card experience. This tactic would mimic the offline experience where a retail store employee asks every customer if they would like to save money today by applying for a credit card.

RESULTS

BlastX’s findings validated that linking to the credit card and rewards membership experience from the cart results in higher-value customers without causing significant harm.

While there would be some loss of shoppers, the visitors who enter, apply, and place an order would generate a higher customer lifetime value for this retailer. With clearer insights into the impact of its rewards program, our client has a tremendous opportunity to further test, iterate, and drive optimizations with its credit card and rewards experiences.

PROJECT OVERVIEW

Goals- Gain a deeper understanding of purchase behavior to optimize the customer experience and journey, specifically leveraging the retailer’s rewards program

- Understand the performance and impact of current credit card and rewards membership sign-up experience

- Segment existing customers engaging with credit card application versus other shoppers to gain key comparative insights

- Implement recommendations to test and measure performance of joint and stand-alone application processes, with a focus on higher funnel engagement

- Linking to the credit card and rewards membership experience from the cart results in higher-value customers, while demonstrating additional opportunities to optimize these programs.