Concerns around digital privacy and security are growing in tandem with increased consumer appetites for great digital experiences. This is happening across industries, but financial institutions may be among the most impacted.

Privacy and security have long been top priorities among consumers when it comes to their finances. Everyone wants to feel assured that their money is safe, their identity is protected, and their transactions are secure. As technology has become increasingly intertwined with finances over the years, the concerns around privacy and security have grown. Many fear the threat of data breaches, hacks, or identity fraud and take those fears into account when choosing where to bank.

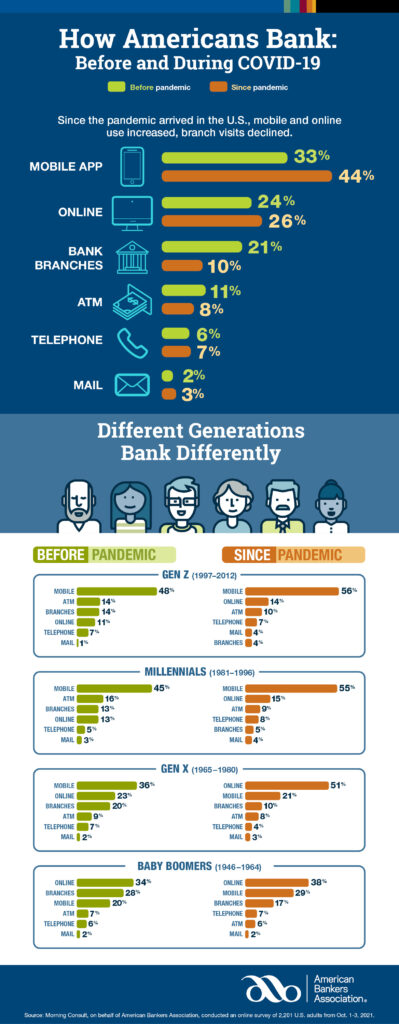

At the same time, bankers are consistently increasing their expectations for what makes a good digital user experience – especially now, due to the pandemic causing fast growth in the appetite for remote banking options. A Boston Consulting Group (BCG) survey, conducted in June 2021, found that a full 44% of 18- to 34-year-olds enrolled in online or mobile banking for the first time during the Covid-19 crisis.

According to a Forbes article from September, these mobile bankers are after best-in-class mobile banking experiences, often turning to larger banks that have had a presence in the mobile banking realm since well before 2020. A survey from J.D. Power points out that “prior to the pandemic, 49% of big bank customers had high levels of digital engagement, compared with 41% of regional bank customers and 36% of midsize bank customers.” To compete with larger players in the space, regional banks and credit unions must mobilize and pay attention to digital experiences now.

Balancing these two priorities – top-notch experiences alongside top notch privacy and security – can be difficult. Here are four emerging trends that will help banks and credit unions bridge the privacy-experience gap and exceed their customer’s expectations on both fronts.

1. Optimize the Consent Experience

First up, let’s talk about consent. Privacy and security rules have gotten stricter over the years and are only getting tighter. Getting consent from your users before you track most data about them is common practice now, but many opt-in experiences are less than optimal.

Coupling the business objective of getting more opt-ins with the consumer’s objective of feeling safe while having the best experience possible is key here. Financial institutions should work to increase their consent opt-in rates by testing different approaches to the content and presentation of opt-in banners. Here are a few things to consider:

Be Transparent

Be upfront and honest about what types of data you’re collecting and what that data will be used for. Consumers will appreciate the transparency, and may be more likely to accept when they’re fully aware of what they’re agreeing to.

Use Everyday Language

Talk to your customers like real human beings, not robots trained on legalese. There may be some legal copy that you have to include, but try to informalize the language wherever possible. Attention spans are short, and most consumers don’t spend more than a few minutes on most websites – so the quicker you can get your point across, the better.

Let Them Know What’s In It for Them

Tell your customers why they should agree to let you track them. If the benefits are just one-sided, what incentive do your customers have for turning over their data to you? Explain how this will help to improve the user experience, and help them see why sharing their data with you may actually be in their best interest as well.

Space Out the Requests

Instead of asking for permission for everything all at once, try serving up privacy notices and opt-ins at various personalized locations throughout their journey. This can help make the requests feel more relevant, and can give your customers peace of mind. They’ll understand that they’re only sharing data with you as absolutely necessary, and will avoid wading through extra notices that don’t pertain to them.

2. Pair Security and Experience as One

Mobile banking is fast becoming the preferred banking method for many consumers. But as mentioned above, concerns about fraud, hacks, data leaks, and security are still very much top of mind. To compete with larger banks, regional banks and credit unions need to address both of these facts. Coupling security enhancements with user experiences that make mobile banking more convenient can help address security fears, while still providing mobile bankers with the convenient functionality they crave.

Fingerprints and facial scans can’t be forgotten, lost, or stolen — and they help consumers feel that their accounts are better protected from threats.

An example of this is biometric log-in features. Conducting a fingerprint or facial scan in order to access the mobile banking app or make a mobile banking transaction is both convenient and extremely secure. Passwords take time to type, and can be forgotten or even stolen, which creates both an inconvenience and a security threat. Fingerprints and facial scans can’t be forgotten, lost, or stolen. They take less time than entering a password, and they help consumers feel that their accounts are better protected from threats.

3. Balance Customer Loyalty and Sentiment While Maintaining Transparency

Maintaining transparency with your customers – especially regarding high-stakes topics like security breaches or fraud – is incredibly important. With something as sensitive as finances, consumers want to know, above all else, that they can trust their financial institution and that nothing is being hidden from them. Approaching these topics can be difficult, though, and must be done carefully as wording, timing and presentation can have a large impact on how the message is received and reacted to.

When it comes to finances, consumers want to know, above all else, that they can trust their financial institution and that nothing is being hidden from them.

For example, on some websites with lead-generation forms, mentioning near the bottom of the form something like “we’ll never sell your data” may seem like a reassuring way to tell your prospective leads that their data is safe with you. However, this type of messaging can actually have the opposite effect. By simply mentioning the notion of “selling data,” consumers are reminded of that risk and may become less inclined to submit the form.

For banks, a recent survey done by Entrust showed that 67% of consumers, when notified of fraud, changed their bank or credit union as a result.

Messaging and delivery are very important. Every audience will react differently and have different preferences regarding how they receive information on these sensitive topics. Taking a proactive approach to learning more about the experience your customers prefer with things like user research, A/B testing, sentiment analysis or Voice of Customer surveys can help you get ahead of these issues and be prepared when they arise.

Whether it’s a seemingly harmless reminder email to your customers about how you’re working proactively to protect them against fraud, or an emergency app notification alerting customers to an actual security breach, making sure you’re taking your customer’s experience into account can go a long way.

4. Use First- and Zero-Party Data to Address Your Customers’ Experience Wants and Needs

Despite consumers’ large appetites for relevant, personalized digital experiences, their tolerance for freely providing the data that makes these types of experiences possible has continued to shrink. Regardless, the expectation remains that websites and mobile apps should continuously improve and adapt to meet the wants and needs of the user.

With privacy rules like Apple’s “ask app not to track” and Safari’s Intelligent Tracking Prevention in place, personalizing experiences for users with data from third-party or even first-party cookies is no longer sustainable. To keep their products relevant, banks and credit unions must now shift their focus to zero-party data collection.

Collecting zero-party data from places like on-site surveys, in-app reviews or call center recordings can help you get to the root of your customers’ specific pain points and understand which experiences they enjoy. Zero-party data is data that your customers freely provide to you, with the specific hope that you’ll use it to make their experience better. Privacy still plays a role in this type of data (more on that here), but since it’s voluntary, you won’t have to worry about losing access.

Personalized Experiences and Privacy Can Coexist

The good news in all of this is that, however impossible it may seem, privacy and great digital experiences can, in fact, coexist. Industry leaders recognize what’s possible and are adapting to the new landscape to attract and retain valuable customers. The key to adapting and successfully navigating these new rules is to take a strategic approach, letting what you know and what you still have to learn about your customers drive the execution.

Whether you’re getting started with zero-party and Voice of Customer data collection, experimenting with your approach to privacy consent, or upleveling your customer journey analytics to pinpoint optimization opportunities, what’s ultimately most important is connecting with your customers and finding ways to reach your goals by meeting their needs first.

We hope this helps you along your journey to bridge the privacy-experience gap at your financial institution. Still have questions? We’d love to hear from you! Request a consultation to discuss your voice of customer and data privacy needs.